Silver’s Generational Super Cycle: 31 Years of Waiting, 15 YearsWelcome to a special macro edition of the Mubite market analysis.

Today, we are zooming out to the 12-Month (Yearly) timeframe on Silver (XAG/USD).

In trading, patience is not just a virtue; it is a requirement for generational wealth. The chart we are looking at today tells a story of massive cyc

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

Silver at $110 in Fierce Rally, Gold Tops $5,100. What’s Behind?(What a chart.)

Silver OANDA:XAGUSD is on a tear. Actually, scratch that — silver is on a mission. Prices have surged more than 250% over the past year, including a blistering 50% jump in January alone, lifting the metal to around $109 an ounce and placing the $110 level firmly in sight .

That

XAUUSD Bullish Structure Intact - $5,040 AheadHello traders! Here’s my technical outlook on XAUUSD (2H) based on the current chart structure. Gold continues to trade within a broader bullish context, maintaining a sequence of higher highs and higher lows. Earlier in the move, price spent a significant amount of time consolidating inside multipl

Again C3.AI - 90 % potential profit - TARGET 24 USDOn the daily chart, the stock remains in a long-term downtrend; however, downward momentum has clearly weakened in recent weeks. Price has stabilized around the 12–13 USD area, which previously acted as a demand zone. This price behavior suggests a possible accumulation phase following a prolonged d

Only God or Nuclear War Can Break This Weekly Gold ResistanceA Resistance That Has Stopped Gold for 20 Years

On the weekly chart, gold has respected the same rising resistance line through every major global crisis:

May 2006 – ~$723

September 2011 – ~$1,900

Now / early 2026 projection – ~$5,000–$5,200

Each time price reached this zone, the world was u

UJ, Yen takes over, Weekly Overview and Upcoming week PlanThe week:

Exiting week for the pair, first signs of weakness in the trend confirmed both by the pattern and level where it happen. A text book evening star at the same level where the found resistance and reversed on the week of 13 January last year, so know we have 3 confirmations: Time, Pattern

BTC Is Not Weak — It’s Just Quiet Before the Next Big WaveIf I look at BTCUSDT right now through the lens of someone who has lived through multiple market cycles, what I see is a market that is calm rather than weak.

Recent news hasn’t delivered a major catalyst, and that is actually a positive sign. There is no new macro pressure, no unexpected bad ne

Want to Know Where Gold is Heading? Look at JP10Y!Want to Know Where Gold is Heading? Look at JP10Y!

+0.89 correlation: Did you know about this relationship between Japanese bonds and gold?"

One of the most overlooked indicators by gold investors is Japanese Government Bonds (JP10Y). When we examine the price movement over the past 5 years, a sur

Doge and a BIG rise!Hi!

As shown on the chart, DOGE has clearly broken above the long-term descending trendline, which had been acting as resistance for several weeks. Following this breakout, price moved higher and confirmed the shift in market structure.

Importantly, the breakout was supported by a strong bullish e

Netflix Stock Dives as Crowds Reach for the Remote: Binge Over?Netflix NASDAQ:NFLX investors who hit play heading into the earnings were expecting a feel-good episode. Instead, they got a cliffhanger — and not the good kind.

Shares of the streaming giant are lower by about 5% pre-market Wednesday, even after the company posted better-than-expected fourth-qu

See all editors' picks ideas

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

Volatility Risk PremiumTHE INSURANCE PREMIUM OF THE STOCK MARKET

Every day, millions of investors face a fundamental question that has puzzled economists for decades: how much should protection against market crashes cost? The answer lies in a phenomenon called the Volatility Risk Premium, and understanding it may fundam

Volume Gaps & Imbalances (Zeiierman)█ Overview

Volume Gaps & Imbalances (Zeiierman) is an advanced market-structure and order-flow visualizer that maps where the market traded, where it did not, and how buyer-vs-seller pressure accumulated across the entire price range.

The core of the indicator is a price-by-price volume prof

Match Finder [theUltimator5]Match Finder is the dating app of indicators. It takes your current ticker and finds the most compatible match over a recent time period. The match may not be Mr. right, but it is Mr. right now. It doesn't forecast future connection, but it tells you current compatibility for today.

Jokes aside,

See all indicators and strategies

Community trends

United Health - Losing $60bln in one day!📢United Health ( NYSE:UNH ) still overall remains bullish:

🔎Analysis summary:

Just within a couple of hours, United Health wiped out $60bln. And despite this massive -20% drop, United Health is approaching a major confluence of support. After we see bullish confirmation, a rejection higher is

CRDO in BUY ZONEMy trading plan is very simple.

I buy or sell when at either of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow volume spikes beyond it's Bollinger Bands

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone at bottom top of ch

$UNH 2027 Cap will make it a dog for 2026?- NYSE:UNH was expected to bottom in 2025 and head higher on a condition that they would be able to increase the prices.

- If 2027 , prices are capped then it basically choke growth aspects of the company and would stagnate EPS massively for 2027

- NYSE:UNH expects 17.75 in EPS for 2026

- I bel

Newmont (NEM): On the Road to $100?Newmont's recent price action, combined with the strength in gold, is starting to flash a familiar pattern — one that, historically, has preceded major rallies. With gold trading firmly above $2,500/oz and Newmont delivering strong free cash flow ($1.2B in Q1), the fundamental backdrop couldn’t be m

MICROSOFT on a short-term rebound before drop to $410.Around 3 months ago (November 06 2025, see chart below) we gave a Sell Signal on Microsoft (MSFT) targeting $450:

The signal was confirmed and the target got hit last week, with the price immediately rebounding as it hit the 0.5 Fibonacci retracement level from the April 07 2025 Low.

This Low

$AMZN - Inverted Head and Shoulders Pattern Perfect Setup!Hello My Exit Liquidities!

The Head and Shoulders pattern is one of the most used and noticed patter in trading

In this case we have a inverted head and shoulders which is just a regular head and shoulders, but upside down

When seeing a regular head and shoulders people usually look to go short t

AMZN - Amazon at a Decision Point – Breakout or Pullback?Hello Everyone, Followers,

Same as usual I will share 3 different analysis this week as well and Amazon is the first one.

Lets drill down:

🔍 Technical Overview

Amazon is trading inside a rising wedge / converging structure, with price respecting both the ascending support trendline and the desc

When Price Returns to the Balance ZonePreviously, Tesla had a clear impulsive rally that pushed price into the 490–500 USD area. This was a leadership-type move, where active capital drove price decisively away from its balance zone. But like any healthy trend, the market can’t move in a straight line forever. As short-term momentum fad

See all stocks ideas

Jan 27

NEENextEra Energy, Inc.

Actual

0.54

USD

Estimate

0.53

USD

Jan 27

UNHUnitedHealth Group Incorporated

Actual

2.11

USD

Estimate

2.10

USD

Jan 27

UPSUnited Parcel Service, Inc.

Actual

2.38

USD

Estimate

2.20

USD

Jan 27

PROVProvident Financial Holdings, Inc.

Actual

0.22

USD

Estimate

0.35

USD

Jan 27

AITApplied Industrial Technologies, Inc.

Actual

2.54

USD

Estimate

2.49

USD

Jan 27

JBLUJetBlue Airways Corporation

Actual

−0.49

USD

Estimate

−0.46

USD

Jan 27

GMGeneral Motors Company

Actual

2.51

USD

Estimate

2.26

USD

Jan 27

KMBKimberly-Clark Corporation

Actual

1.86

USD

Estimate

1.81

USD

See more events

Today

PPHCPublic Policy Holding Co. Inc.

Exchange

NASDAQ

Offer price

—

Tomorrow

LIFEEthos Technologies Inc.

Exchange

NASDAQ

Offer price

18.00 - 20.00

USD

Tomorrow

P

PICSPicS NV

Exchange

NASDAQ

Offer price

16.00 - 19.00

USD

Tomorrow

YSSYork Space Systems Inc.

Exchange

NYSE

Offer price

30.00 - 34.00

USD

Feb 2

H

HWEPHW ELECTRO Co. Ltd.

Exchange

NASDAQ

Offer price

—

See more events

Community trends

Bitcoin - Failed Recovery, Liquidity Below Becomes the TargetMarket Overview

Bitcoin is showing clear bearish intent on the daily timeframe. The broader structure has shifted to the downside, with price struggling to sustain any meaningful continuation higher. Daily momentum remains weak, and each attempt to reclaim higher levels is being met with aggressive

APEX - 10x | 100x potential on this altcoin!APEX is a very promising professional decentralized exchange / platform that's why I share with you this technical analysis! I am not really encouraging people to buy the top, don't do that! Always wait for a pullback. As we can see on the weekly chart, APEX made a pretty significant pullback and fi

BITCOIN - Consolidation below 90K. Weak marketBINANCE:BTCUSDT failed to break through the 90K area, and the market is forming a cascade of resistance, indicating the dominant position of sellers in the current circumstances.

The market still looks quite weak, and any attempts at growth are a hunt for liquidity. Global and local trends ar

Bitcoin Descending Channel Signals Further Downside To $86,100Hello traders! Here’s my technical outlook on BTCUSD (4H) based on the current chart structure. BTCUSDT initially traded inside a well-defined range, reflecting a prolonged period of balance between buyers and sellers. This consolidation phase ended with a clean upside breakout, signaling a shift in

BTCUSDT Long: Reacts From Demand - Pullback Toward $89,500Hello traders! Here’s a clear technical breakdown of BTCUSDT (2H) based on the current chart structure. Bitcoin previously traded within a well-defined ascending channel, confirming a strong bullish phase with consistent higher highs and higher lows. During this advance, price successfully broke abo

NOT Main Trend. Descending Channel -98% 01/27/2026Logarithm. Time frame: 1 week.

The price is in the main trend and remains in a downward channel with a given volatility range.

It's important to understand that the creators of this cryptocurrency always sell at any price (they're created for profit, fueled by hype). However, at low prices

Elise | BTCUSD | 30M – Bearish Continuation Below StructureBITSTAMP:BTCUSD

After a sharp sell-off, BTC attempted a corrective pullback but failed to regain acceptance above resistance. The bounce appears corrective rather than impulsive, suggesting sellers are still in control. As long as price remains capped below resistance, downside liquidity remains t

BTCUSDT is manipulating the liquidity zone The market structure is bearish, with an upward momentum forming in response to the growth of the US stock market (S&P 500). As part of a countertrend correction, Bitcoin may test the zone of 89,200 (0.6 Fibonacci) - 89,800 (order block from the 0.7 Fibonacci zone).

Buyers are showing a weak react

BTC: Price Update and Likely Next MoveBitcoin managed to break above the 94K resistance level.

That breakout attracted a lot of new long positions, as traders expected a quick move toward higher prices.

Instead of continuing up, price dropped back below 94K.

This move back inside the range likely triggered many stop losses on tho

ETH - The Last Standing Low!ETH is now sitting right around the lower bound of its range, and this isn’t just any support.

This level marks the last standing low from the weekly timeframe, a zone that has already proven it matters.

As long as this weekly low holds, ETH still has a real chance to rotate higher and work its way

See all crypto ideas

XAUUSD: Continues Uptrend After Breakout, $5,170 in FocusHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD is trading within a strong and well-established bullish trend, supported by a clearly defined upward channel that has guided price higher over an extended period. Throughout this move, Gold has consistently r

Gold Price Intraday Analysis – Key Resistance and Support LevelsThis chart provides an intraday analysis of gold prices, highlighting critical levels for potential price action. Key zones include Trendline Resistance at 5,108.974, a Minor Resistance at 5,077.929, and a Support Zone at 5,040.216, where price could potentially bounce. The Key Support Level at 4,98

NQ Short (01-27-26)Since the majority of recent 700 point lift/redirect has come in the overnight off session (not heavy volume), one may think it is less creditable. The use of the O/N to lift or redirect is nothing new, usually when you see heavy usage it is prior to a decent counter move. Not sure why the NYSE is s

GOLD - Waiting for a pullback to enter a long position...FX:XAUUSD continued its record growth for the sixth consecutive day, reaching $5,110. The driving forces behind this are geopolitical uncertainty, expectations of a softening of Fed policy, active purchases by central banks, and an outflow from the dollar...

Fundamental drivers

Geopolitics:

XAUUSD: Bullish Structure Holds Firm as Upside Pressure BuildsLooking at the chart I shared, XAUUSD continues to trade within a clearly defined ascending channel, with price action consistently respecting both the upper and lower boundaries. This is a textbook bullish structure. Each pullback remains controlled, and buyers continue to step in at higher levels,

Silver - Here comes the bullrun top!☠️Silver ( OANDA:XAGUSD ) creates its final top now:

🔎Analysis summary:

Silver still remains totally bullish. But Silver also remains totally overextended and the metal is also approaching the final resistance trendline. With all of this short term weakness, this might be the final top on Sil

Hellena | GOLD (4H): LONG to resistance 5200.Since the movement continues and clearly shows no signs of reversing, I had to slightly revise the wave count, and it looks as if the impulse has been extended.

This means that the higher-order wave “3” has just ended or will end soon.

This means that wave “5” is not over yet and we should expect a

XAUUSD (1H, chart pattern)...XAUUSD (1H, chart pattern).

bullish structure is still intact 💛📈

Here’s the clean target based on what i’ve drawn.

🎯 Targets (bullish continuation)

TP1: 5,080 – 5,090

→ Recent highs / minor resistance

TP2 (main target): 5,190 – 5,210

→ Measured move from the trendline + breakout projection

(this ma

XAUUSD Long: Consolidation Before the Next Impulsive MoveHello traders! Here’s a clear technical breakdown of XAUUSD (1H) based on the current chart structure. Gold is trading within a strong and well-defined ascending channel, confirming a sustained bullish trend supported by consistent higher highs and higher lows. This structure reflects strong buyer d

GOLD Defies Logic as Market Awaits the Next MoveGOLD Defies Logic as Market Awaits the Next Move

After the Davos meeting on January 21, GOLD did not react to Trump’s comments. Still, the price jumped almost +5.8%, rising from 4800 to 5110 with no clear reason.

I believe a larger correction is needed. I expected GOLD to start a downward move ar

See all futures ideas

EURUSD Short-Term Correction Within Bullish StructureHello traders! Here’s my technical outlook on EURUSD (1H) based on the current chart structure. EURUSD recently shifted into a bullish phase after completing a prolonged corrective move inside a descending channel. Price respected the lower boundary of that channel multiple times, forming higher rea

EURUSDHello Traders! 👋

What are your thoughts on EURUSD?

EUR/USD has successfully broken above the descending trendline as well as a key resistance zone, confirming a bullish breakout on the daily timeframe.

At current levels, price is approaching a resistance area. Therefore, a short-term correction

USD/JPY: True Bullish Reversal?!The 📈USDJPY pair formed a well-defined inverted head and shoulders pattern following a test of a significant historical support level.

A decisive bullish breakout above its neckline, confirmed by a strong bullish candle, would provide a reliable indication.

I anticipate a correctional movement t

EURUSD: Corrective Pullback After Strong Bullish ImpulseHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD has been trading within a well-defined upward channel, which reflects a strong bullish structure over the higher timeframe. Price has consistently respected the channel boundaries, forming higher highs and hi

EURCAD Price Update – Clean & Clear ExplanationEUR/CAD made a strong impulsive bullish move, breaking above multiple previous resistance zones, which confirms bullish momentum Price is now approaching a major resistance and supply zone near the top (highlighted in red). This area is important because it aligns with:

Because of this confluence,

USDJPY 30-Min — Volume Buy Reversal Triggered⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

Technical Reasons

/ Direction — LONG / Reversal 153.420 Area

Eurusd will be bullish EURUSD is trading inside a clear range, with price reacting from the support zone around 1.1836. A bullish rebound from this level can push price toward the resistance area near 1.1899–1.1907. If resistance breaks and holds, the next upside target lies around 1.1925. Overall bias remains bullish abo

CADJPY Signals Deeper Correction AheadCADJPY Signals Deeper Correction Ahead

The recent price action shows a clear rejection from the upper boundary of the pattern, followed by a sharp bearish impulse, signaling a potential shift in momentum.

Price is now trading below the broken support, suggesting that the bullish structure is weak

Weak USD, EURUSD Ready to Push HigherIn the short term, the US dollar is lacking strong bullish momentum as markets move into a wait-and-see mode ahead of the Fed , while recent US economic data has failed to trigger fresh USD buying. As a result, USD weakness remains largely technical in nature, indirectly allowing EURUSD to maint

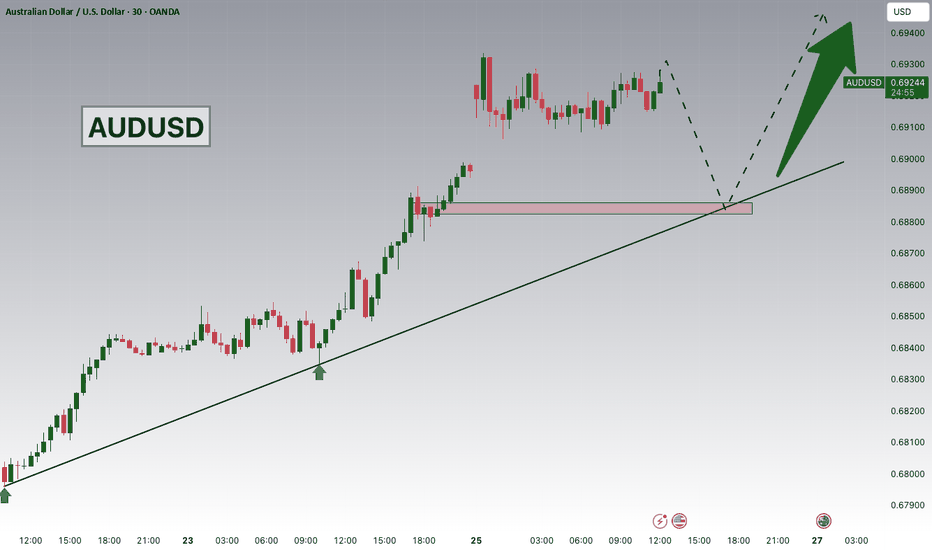

AUDUSD Strong Bullish Momentum!Hey traders, in today's trading session we are monitoring AUDUSD for a buying opportunity around 0.68800 zone, AUDUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 0.68800 support and resistance area.

Trade safe, Joe.

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.